Looking for efficient tax returns? elss is the way forward

As investment experts, we have always got questions seeking tips on tax saving investment options. While we always prefer you sit down for a cup of coffee with us, as we study your income and expenditure and then suggest the best suited option, today we’re going to talk about something that will all of us save on our taxes.

ELSS!

An ELSS mutual fund, or Equity Linked Savings Scheme, is a type of fund that helps investors save money on taxes. While it comes with a specific lock in period, what makes it a safe option is that it also gives great returns.

How does ELSS help save tax?

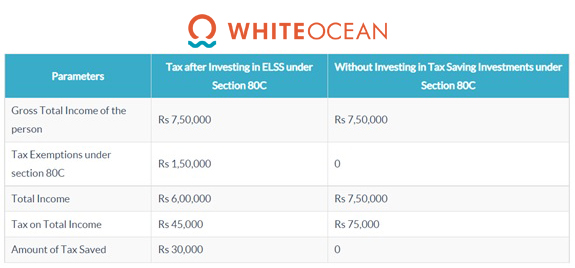

By investing up to Rs.1.5 lakhs per year in an ELSS, one can get a tax benefit of up to Rs. 46,800 under section 80C. While you can invest more than Rs. 1.5 lakhs in an ELSS, but you won’t be eligible for a tax benefit if your investment exceeds the figure. But, even if a person falls under the maximum tax bracket of 30%, that person can save a maximum of Rs. 45,000 on tax.

Let’s simplify it for you. This table below will help you understand how ELSS funds work and the amount of tax it would save for you.

We’ve taken the sample income of a certain Mr. X as Rs 7,50,000 per annum. We have shown the difference in their savings if they invested in ELSS funds as compared to having no investments at all.

Who can invest in ELSS Funds?

- Salaried Employees: As a salaried employee, ELSS is the best option when it comes to balancing out the risk & return in your portfolio. Yes, the Unit Linked Insurance Plans (ULIP) and the National Pension Scheme (NPS) do offer a similar deduction under section 80C, their lock-in periods are longer, i.e. 5 years in ULIP and up to 60 years in NPS, compared to ELSS, which has only 3 years.

- First-time investors: When you choose ELSS as your first mutual fund to invest in, you get the exposure to equity investing, the safety of investing in monthly Systematic Investment Planning (SIP), and accumulate more units when the market is in red and generate exceptional returns when the markets are favourable. Oh, and the savings on taxes are obviously there.

How to invest in ELSS Funds?

- The Growth Option – When you pick the growth option while investing in ELSS Mutual Funds, you receive the benefits at the time of redemption post lock-in period. The profits are high as the net asset value (NAV) of your investment appreciates over time. Of course, the returns are subject to market risk.

- Dividends Just like its name, you reap in the benefits in regular intervals in the form of dividend payments, and yes, they are tax-free. But, dividends are declared only when the company makes excessive profits over and above its regular profits.

- Dividend Re-investments Yes, what you’re thinking is absolutely correct. The dividend you earn gets re-invested into the funds, adding to the NAV. You should choose this option if you’re interested in cashing on the long term upswing the market is witnessing.

Be mindful of these factors prior to investing in ELSS Funds

- Returns on the Fund: Always take time out to do your bit of research, to know how your chosen fund and its competitors are performing in comparison to each other. Or, you can get our expert financial advisors can you do it for you. Go for the one with consistency in returns.

- Consistency is the key: If a fund has maintained its performance rate for over 5 years, it’s a safe option for you.

- Expenses ratio: Expense ratio means the amount spent by towards its management. Only choose the ones with lower expense ratio, so that you can take home higher returns.

- Financial parameters: The performance of a fund can also be analysed on the basis of parameters like Standard Deviation, Sharpe Ratio, Alpha and Beta. And if you don’t wish to get into all the mathematics of it, our experienced financial advisors are here for you to provide expert advice on mutual funds.

And most importantly…

- The right fund manager: Your fund manager is your best friend when it comes to investing right. And we are your best friends when it comes to not just investing right, but earning big and saving well.

With White Ocean’s expert advisors, pick the right stocks and creating a strong portfolio. Drop us a hello at [email protected] today!