Budget 2022 sectors that look promising to rev up economic growth

Finance Minister Nirmala Sitharaman will present the Union Budget for the financial year 2022-23 on 1 February at 11 am. The annual financial statement by the government presents an overall picture of the financial position of the Government of India, including that of Railways. It also earmarks the allocation of funds for defence.

Here’s a brief look and which sectors can expect a great push from the government for the upcoming year.

Defense

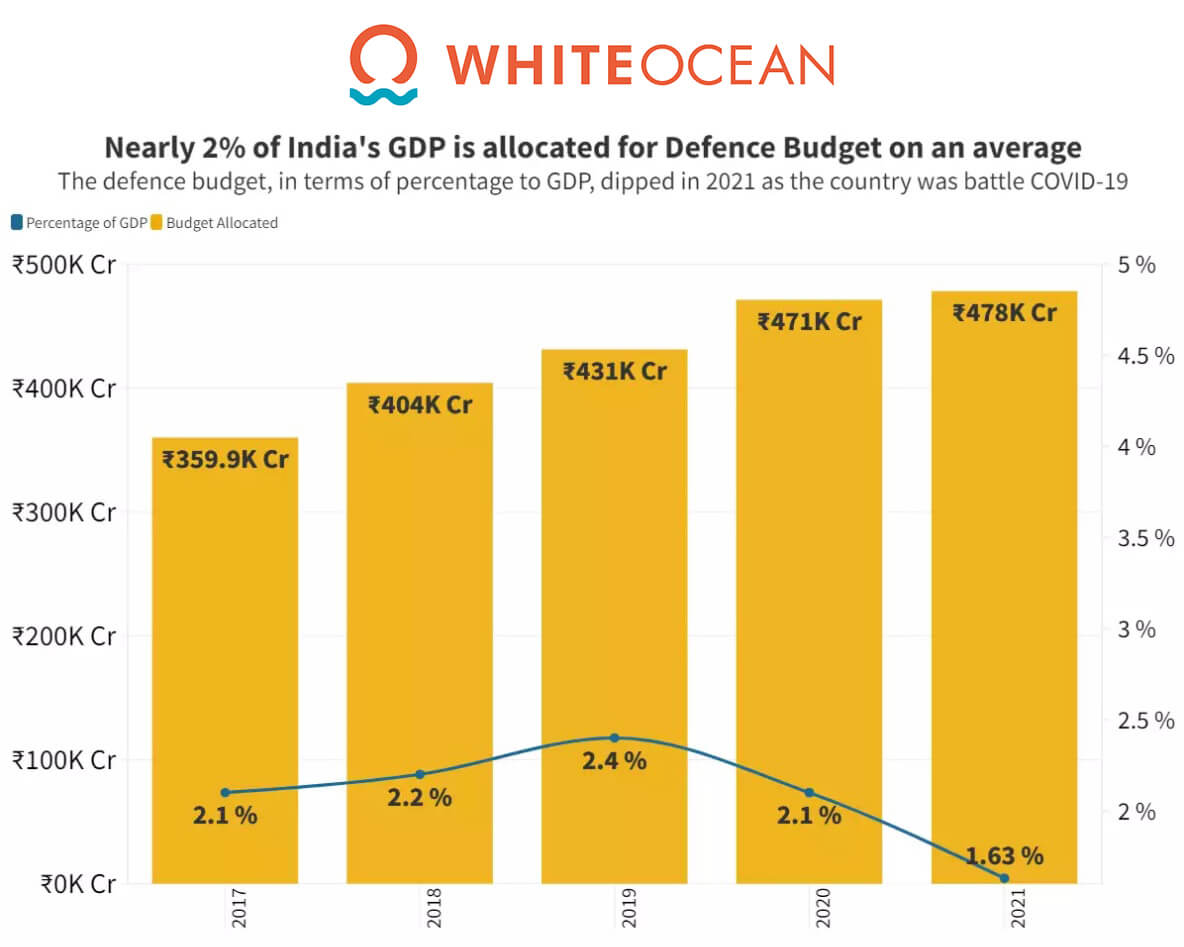

Making the Indian defense sector self-sufficient is one of the most ambitious tasks the government has taken on in realising the dream of becoming an Aatmanirbhar Bharat (self-sufficient). India’s Defense budget has remained consistent roughly at 2% of the GDP in the last five years. The government has the vision of achieving a turnover of Rs. 175,000 crores, which includes the exports of Rs. 35,000 crores in Aerospace & Defense goods and services by 2025.

The forthcoming annual budget can further contribute to this goal in two ways. Firstly, by ensuring a requisite capital budget allocation for modernizing Indian Aerospace and Defense and thereby ensuring sustained demand in a sector where Government is the sole buyer. Secondly, by introducing tax incentives to create a more conducive and lucrative environment for A&D players in India.

Fertilizers

In the first week of new year 2022, major news publications reported from strong government sources that the finance ministry has penciled in Rs. 1.4 lakh crore as fertilizer subsidy in the budget due February 1, up from Rs. 1.3 lakh crore in the year ending March 31, due to higher raw material costs.

India is the second-largest consumer of fertilizers globally, with an annual consumption of more than 55.0 million metric tons. The market is fragmented with a mix of government-owned and co-operatives garnering a high market share in the straight and complex fertilizer space and private companies engaged in a high degree of product innovation to tap the non-subsidy space.

With Covid-19 persisting and the government not keen to antagonize farmers, prices won’t be allowed to rise in decontrolled phosphatic and potassic (P&K) fertilisers, including di-ammonium phosphate (DAP) in FY23 as well. The surge in fertiliser subsidy has been triggered by rising global rates. The prices of urea, the most commonly used fertiliser, tripled to about $990/tonne while DAP price has more than doubled to $700-800 per ton compared with the level one-and-a-half year ago.

Real Estate – Building Materials Sector And Housing

An important expectation from the government is a reduction in the GST and input tax rates of construction raw materials to 5% from the current 28% for cement, 18& for iron and steel, and 12% for kiln or an input tax credit. These measures will give

the sector a much-required breather without developers increasing property prices to sustain the rising input costs.

The government should come out with measures to incentivise developers for building townships in smaller towns and cities.

Well-planned townships will go a long way in improving the standard of people in such areas. In addition to it, the definition of affordable housing needs to be changed as it is nearly impossible to own a decent apartment under Rs 45 lakh in major cities.

The real estate sector is expected to contribute 13% to India’s GDP by 2025

Railways

The Indian Railways is likely to get a record allocation in Budget 2022, with the government planning to raise the plan capex size by up to 20 percent of last year’s budget estimates. In FY21-22, the government had allocated Rs 2.15 lakh crore, which was the highest ever for the Railways. Of the total

allocation, Rs 7,500 crore came from internal resources and Rs 1 lakh crore from extra-budgetary resources. Another Rs 1.07 lakh crore came from gross budgetary support.

The proposed Rs 2.5 lakh crore capex plan may include Rs 1.25 lakh crore gross budgetary support from the government.

Earnings from PSUs may also increase the extra-budgetary resources of the Indian Railways. The budget allocation will help the Railway Ministry fund long-term infrastructure projects of freight corridors, modernise its fleet and introduce speedier trains.

The government has also set a target of becoming the world’s first 100 percent green railway with net-zero emission by 2030. There is no proposal before the railways to hike passenger fare. Instead, the national transporter will focus on increasing non-fare revenue.

Mobile Manufacturing

Global mobile manufacturing giants Apple and Samsung alone are expected to manufacture/assemble smartphones worth around nearly Rs 37,000 crore in the financial year 2021-22, thanks to the production-linked incentive scheme (PLI) by government as India renews its thrust on local manufacturing of electronics. The PLI scheme provides an incentive of 4 percent to 6 per cent on incremental sales of goods under target segments that are manufactured in India, for five years.

Meanwhile, The India Cellular and Electronics Association (ICEA) in its budget wishlist has requested a roll-back of goods and services tax to 12% from 18%. The government expects mobile phones worth Rs 10.5 lakh crore to be manufactured under the PLI scheme. The industry body has asked for rationalisation of duties on the mother boards (printed circuit board assembly), mechanics components, etc used in mobile phones as well on components used for making mobile phone accessories like Lithium ion cell for power banks, raw materials for wireless and audio devices etc.

On the whole, the challenge for the 2022 Budget will lie not so much in how much fiscal consolidation it proposes but how effectively it is able to ignite India’s growth engines and reduce the economy’s dependence on the government.