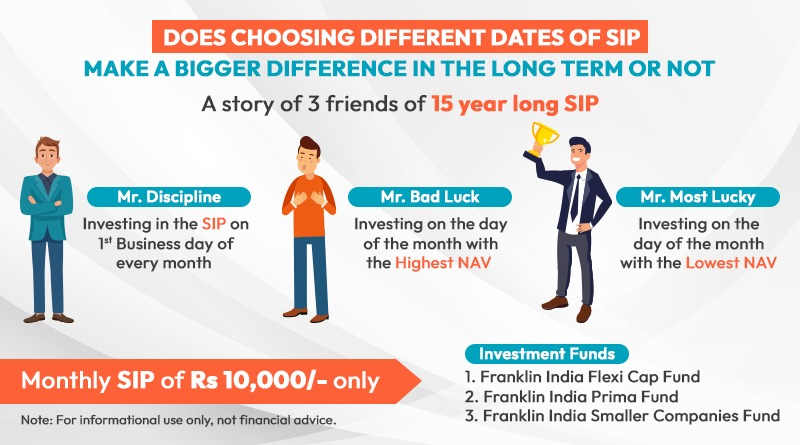

DO CHOOSING DIFFERENT DATES OF SIP MAKE A BIGGER DIFFERENCE IN THE LONG TERM OR NOT

When it comes to investing, most people believe that timing is everything. We’ve all heard it: “Buy low, sell high.” But in reality, investing consistently at the right time is better than investing at the right time.

In this blog, here is the story of three friends who invested the same amount in the same mutual fund over 15 years – but with one difference: the day of the month they invested.

Let us understand with a story :

Meet three friends: Mr. Discipline, Mr. Bad Luck and Mr. Most Lucky. The trio decided to start investing Rs.10,000 every month in mutual funds through SIPs. They did this diligently for 15 years – investing a total of Rs.18 lakh each. Same funds. Same amount. Same duration. But everyone had a different approach to timing their monthly investments.

- Mr. Discipline:

Invested on the 1st business day, every month, no matter what. - Mr. Bad Luck:

Somehow he always picked the worst day to invest each month. - Mr. Most Lucky:

Always hit the best day – every time.

Now, After 15 years, let’s talk numbers. Each friend invested Rs.10,000 per month for 180 months = Total Rs.18,00,000.

The Results :

- Franklin India Flexi Cap Fund

Mr. Discipline: ₹65.00 lakh

Mr. Bad Luck: ₹63.11 lakh

Mr. Most Lucky: ₹66.88 lakh - Franklin India Prima Fund

Mr. Discipline: ₹76.69 lakh

Mr. Bad Luck: ₹74.25 lakh

Mr. Most Lucky: ₹78.90 lakh - Franklin India Smaller Companies Fund

Mr. Discipline: ₹85.01 lakh

Mr. Bad Luck: ₹82.10 lakh

Mr. Most Lucky: ₹87.60 lakh

The difference between best and worst? Only about ₹3–4.5 lakh over 15 years.

The Lesson :

Mr. Discipline didn’t chase the market. He didn’t wait for the lowest NAV or panic at market highs. He just invested – every month.

Even Mr. Bad Luck, who always invested at the worst time, built significant wealth. Why? Because they both stayed consistent.

Conclusion

This story proves one thing: Consistency beats timing. You don’t need to be lucky – you need to be disciplined. So don’t wait for the “perfect” time. The right time isn’t about the market-it’s about your mindset. Start your SIP, stay the course, and let time and discipline do its magic.